Choosing the right credit card when you have bad credit is an important decision. Whilst having a poor credit score may reduce the number of options available, getting a credit card for low credit score in the UK is possible – and it’s still important to choose a card that fits your financial situation. In this article, we’ll discuss some of the things you may wish to consider when choosing a credit card for bad credit.

Check Your Credit Score

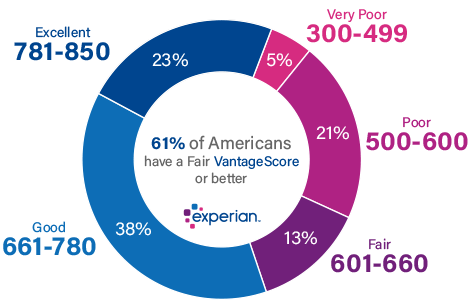

The first step in choosing the right credit card with poor credit is to check your credit score. In the UK, you can obtain a free credit report from any of the three main credit reference agencies: Experian, Equifax, and TransUnion. Knowing your credit score will help you determine which cards you are likely to qualify for, before you apply for a credit card with really poor credit. This also may help to give you an idea of the interest rates and fees you might expect to pay.

Compare Interest Rates and Fees

When choosing a credit card for bad credit, it’s important to compare interest rates and fees. Generally, the higher your credit score, the lower your interest rate will be. However, with bad credit, you can expect to pay higher interest rates and fees. Look for cards with the lowest interest rates and fees possible to help minimize the amount of interest you’ll have to pay over time.

Look for Cards with No Annual Fee

Some credit card providers do charge an annual fee. Before you apply for a credit card with bad credit, make sure you look for a card without an annual fee such as the thimbl. credit card. While this fee may be relatively small, it’s still an added expense that you’ll have to pay each year. By looking for cards without an annual fee this will help to reduce your overall costs of borrowing and avoid building up unsustainable credit which may cause further damage to your score.

Consider Rewards and Perks

While rewards and perks may not be a top priority when choosing a credit card for bad credit, they can still be a nice bonus. Look for cards that offer rewards or cashback on your purchases, or that come with additional perks like travel insurance or purchase protection. Just as annual fees might increase the overall cost of borrowing, having extra benefits and rewards for using your credit card might help to reduce the overall cost. After all, every little helps!

Read the Fine Print

Finally, be sure to read the fine print when choosing a credit card for bad credit. Look for any hidden fees or penalties that may apply, and make sure you understand the terms and conditions of the card before you apply. Be aware that some cards may have restrictions on how much credit you can use, or may require you to make a certain number of payments on time before increasing your credit limit. In conclusion, choosing the right credit card for bad credit is all about understanding your financial situation and finding a card that fits your needs. By checking your credit score, understanding the different types of credit cards, comparing interest rates and fees, looking for cards with no annual fee, considering rewards and perks, and reading the fine print, you can choose a card that will help you build your credit score over time and achieve your financial goals.…